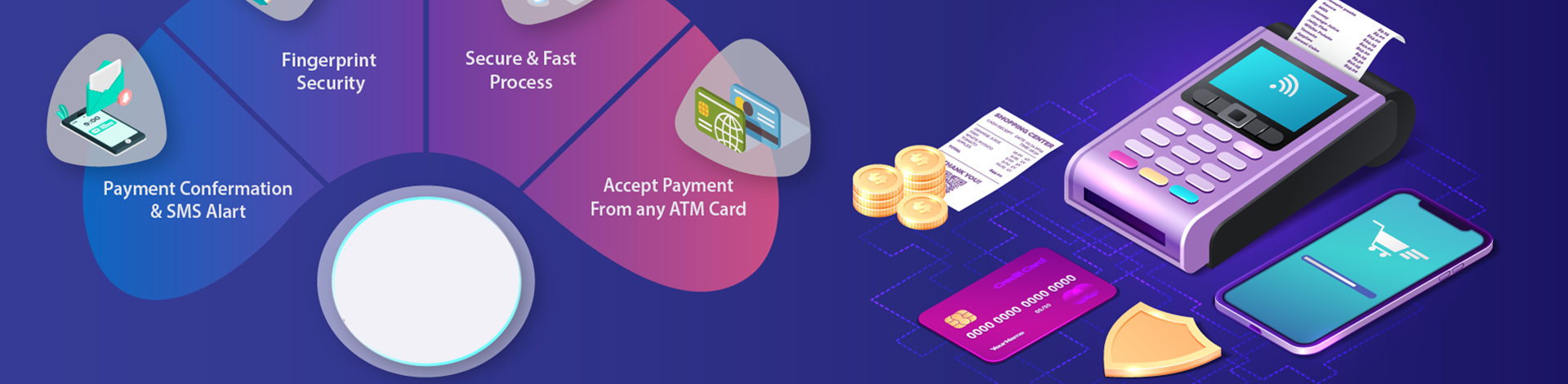

Micro ATM Services

The MicroATM Machine is operated by an agent that will includes a card reader for all cash withdrawal and balance enquiry transactions from all bank debit cards. All Transaction can be done Micro/mini ATM? - Cash Withdrawal (cash out from bank account)

- Convert your shop into an ATM booth

- Get a low-cost ATM, the best option for the current ATM

- Use this Portable device in many ways

- Set up and carry your ATM Services anywhere

- Interoperate this device and use it for any banks

- Help people of your area, especially in a rural area