Enrolment of Atal Pension Yojna (APY)

Atal Pension Yojana (APY) is a government-backed pension scheme aimed at providing financial security to individuals after their retirement.

Enrolment of Pradhan Mantri Suraksha Bima Yojna (PMSBY)

Fill in the PMSBY application form and provide the necessary information such as name, age, bank account details.

Enrolment of Pradhan Mantri Jeevan Jyoti Bima Yojna (PMJJBY)

Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) is a government-backed life insurance scheme that provides financial security.

Account Opening

Types of accounts: Banks typically offer different types of accounts such as savings account, checking account, money market account, certificate of deposit (CD), etc.

Cash Deposit (Own Bank)

Go to the bank branch or ATM and follow the instructions to deposit the cash. If you're depositing cash at a bank branch, you may need to fill out a deposit slip.

Cash Withdrawal (On us)

A cash withdrawal (on us) refers to the act of withdrawing money from an Automated Teller Machine (ATM) that belongs to your own bank or financial institution.

Cash Withdrawal (Off us)

When you withdraw money from an ATM that is not operated by your bank, the transaction is referred to as an "off us" transaction.

Fund Transfer (Own Bank)

A fund transfer (own bank) refers to the process of moving money from one account to another within the same bank or financial institution.

Balance Enquiry

This can be done through various channels such as online banking, mobile banking, phone banking, or by visiting a branch without additional fees.

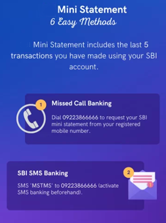

Bank Mini Statement

A bank mini statement is a document that shows a summary of the recent transactions made on a bank account. It typically includes details such as the date of the transaction

IMPS

IMPS stands for Immediate Payment Service and is a real-time interbank electronic fund transfer system in India. It was launched by the National Payments Corporation of India (NPCI) in 2010.

Recovery/ Collection up to Bank approved limits

Recovery/Collection up to Bank approved limits refers to the process of recovering the outstanding dues from borrowers by banks within the approved limits.

NEFT

NEFT stands for National Electronic Funds Transfer, and it is a payment system that enables electronic transfer of funds from one bank account to another bank account in India.

Term Deposit/ Recurring Deposit Opening

Term Deposit and Recurring Deposit are two types of fixed deposit accounts offered by banks in India. Both accounts allow customers to earn interest on their savings.

Request for new Cheque Book

Requesting a new chequebook is a simple process that can be done both online and offline. A chequebook is an essential tool for making payments.

Stop Payment of Cheque

Contact your bank: You can contact your bank's customer service helpline or visit the nearest branch and request a stop payment on the cheque.

Cheque Status Enquiry

Checking the status of a cheque that you have issued is an important step to ensure that the cheque has been successfully cleared and the payment has been made.

Renewal of Term Deposit/ Recurring Deposit

Renewal of a term deposit or recurring deposit is a process that allows you to extend the tenure of your deposit account. It is an important.

Block Debit Card

Blocking a debit card means suspending its use temporarily or permanently, depending on the reason for blocking it. A debit card can be blocked for various reasons.

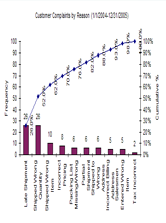

Launch Complaints

When launching a complaint with a bank, it is important to provide specific details about the issue you are experiencing.

Track Complaints

When tracking a complaint with a company, it is important to follow up regularly to ensure that the issue is being resolved.

Request for SMS alert/ e-mail statement

I have already registered my mobile number/ e-mail with your bank, and I would like to receive regular updates on my account balance.

Pension Life Certificate authentication through Jeevan Pramanam

Jeevan Pramanam is a digital service offered by the Government of India .

Apply for RuPay Debit cards

Visit the website or branch of a bank that issues RuPay debit cards,Look for the option to apply for a debit card,Fill out the application form with your personal and account.